IMF and World Bank real culprits in Africa's debt crisis

By Jehron Muhammad | Last updated: Sep 12, 2018 - 4:04:56 PMWhat's your opinion on this article?

|

The phrase they use to accuse China is “debt book diplomacy,” a play on the past usage of the term “gunboat diplomacy” about U.S. policy. They accuse China of miring Africa in debt and “undercutting their sovereignty.”

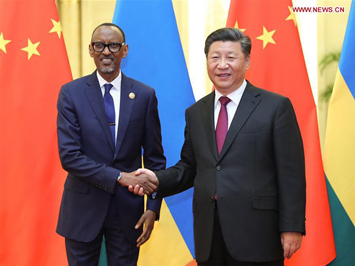

Chinese President Xi Jinping (R) meets with African Union Chair Paul Kagame who is President of Rwanda at the Great Hall of the People in Beijing, capital of China, Sept. 4, 2018. (Xinhua/Ju Peng)

|

Pushing back, China claims to be helping African development, not piling up debt, one top China government official said.

“If we take a closer look at these African countries that are heavily in debt, China is not their main creditor,” its special envoy for Africa Xu Jinghy said, during a news conference. “It’s senseless and baseless to shift the blame onto China for debt problems.”

Claims that China is an “economic predator” in Africa, pillaging natural resources and draggling it into debt crisis are “as false as they are sensational,” the Xinhua official Chinese news agency said in a commentary.

According to African economic and political analyst Lawrence Freeman, “It is more than ironic that the West is complaining about Africa’s debt to China. Since the 1960s, Western nations, the IMF, World Bank, Paris Club, etc., have ‘looted’ Africa of hundreds of billions of dollars in bloated debt payments and through the manipulation of currencies, and terms of trade.”

Of note is the fact that the anti- China accusation is fairly recent. An April 18 Financial Times article, headlined “African nations slipping into new debt crises,” did not mention China one time as the source of the continent’s debt crisis.

In fact the FT’s piece is critical of the International Monetary Fund and World Bank. “The increase in debt should have raised all sorts of flags and triggered triage, but it didn’t. Neither the International Monetary Fund nor the World Bank sounded the alarm,” the London-based financial paper reported.

In addition, the FT claimed some African countries were hit because “they borrowed in foreign currencies and were finding debt hard to finance after a significant depreciation.”

In 2017 Quartz Africa reported, again not mentioning China, that “African eurobond debt is growing to risky levels.” A eurobond, also referred to as sovereign bond, is a debt security issued by a national government and is denominated in a foreign currency, usually dollars, rather than the euro that its name implies.

This debt crises have been cyclical. Africa’s debt of the 1980s mushroomed to $270 billion and had many factors, according to Quartz, “depending on which side of the fence you’re on.”

Those events came full circle. Even though Quartz recognized the repeating “hallmarks” of unchecked corruption, poor governance, and political mileage investment, the “single catalytic factor to trigger debt unsustainability in Africa has always been the crash of commodity prices on the global market.”

The news service Reuters reported in May of 2017 that “most sub-Saharan African countries still rely on U.S. dollar-denominated debt to finance their economies. Some investors say this is sowing the seeds of future debt crises if local currencies devalue and make dollar debt repayments more expensive.”

The United Nations trade body UNCTAD estimates that Africa’s external debt rapidly grew to $443 billion by 2013 through bilateral borrowing, syndicated loans and bonds. But since then sharp currency devaluations across the continent have pushed up the cost of servicing this debt pile, which continues to grow, the agency said.

It’s no wonder over 50 African heads of state attended the Sept. 3-4 Forum on China-African Cooperation (FOCAC) in Beijing. During the forum China president Xi Jinping announced a hefty $60 billion package to compliment another $60 billion pledged at the 2015 summit.

This breaks down, according to press reports, to $15 billion in grants and interest free loans, $20 billion in credit lines, a $10 billion fund for development financing, $5 billion to finance imports from Africa and waving the debt of the poorest African nations diplomatically linked to China.

On top of President Jinping letting the numbers speak for themselves he had words for China’s detractors: “Only the people of China and Africa have the right to comment on whether China-Africa cooperation is doing well … . No one should deny the significant achievement of China-Africa cooperation based on their assumptions and speculations.”

The African Union chairman, Rwandan President Paul Kagame, has been heard to call Chinese aid and investment strategy in Africa “deeply transformational” and respectful of the continent’s global position.

He said FOCAC had grown into a powerful engine “of cooperation fully aligned with Africa’s Agenda 2063 and sustainable development goals.”

“Our growing ties with China do not come at anyone’s expense. The gains are enjoyed by all who do business with us. Building the capacity of African institutions to transact and monitor more effectively is what will make the biggest difference,” he said.

Follow @jehronmuhammad on Twitter.

INSIDE STORIES AND REVIEWS

-

-

About Harriett ... and the Negro Hollywood Road Show

By Rabiah Muhammad, Guest Columnist » Full Story -

Skepticism greets Jay-Z, NFL talk of inspiring change

By Bryan 18X Crawford and Richard B. Muhammad The Final Call Newspaper @TheFinalCall » Full Story -

The painful problem of Black girls and suicide

By Charlene Muhammad -National Correspondent- » Full Story -

Exploitation of Innocence - Report: Perceptions, policies hurting Black girls

By Charlene Muhammad -National Correspondent- » Full Story -

Big Ballin: Big ideas fuel a father’s Big Baller Brand and brash business sense

By Bryan Crawford -Contributing Writer- » Full Story

Click Here Stay Connected!

Click Here Stay Connected!